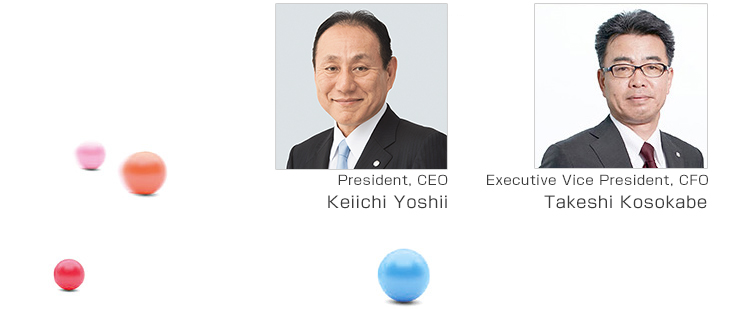

Message from the Management

-- To all our shareholders and investors --

In the results for FY2023, the second year of the 7th Medium-Term Management Plan, net sales reached a record high. Excluding the impact of actuarial differences, operating income reached a record high and increased for the third consecutive year.

In the fiscal year ended March 31, 2024, the Japanese economy recovered moderately amid signs of inbound demand backed by the weaker yen, higher wager growth, and the pass-through of higher resource and labor costs to prices. However, the economic outlook remained uncertain, given persistent yen weakness and the impact of geopolitical risks such as the protracted Russia-Ukraine conflict and the deteriorating Middle East situation on resource prices.

Amid this operating environment, the Group has actively pushed forward various high-value-added proposals and measures to realize a sustainable growth model, including expanding its overseas businesses and stock businesses and leveraging digital transformation to enhance the customer experience, under the three management policies: Evolve revenue model, optimize management efficiency, and strengthen management base in the 7th Medium-Term Management Plan, a five-year plan launched fiscal year 2022.

As a result, the Daiwa House Group recorded consolidated net sales of 5,202,919 million yen (+6.0% year on year) for the fiscal year ended March 2024. Operating income came to 440,210 million yen (-5.4% year on year), ordinary income came to 427,548 million yen (-6.2% year on year), while net income attributable to owners of the parent amounted to 298,752 million yen (-3.1% year on year).

Operating income above includes 46,515 million yen gain on amortization of actuarial differences for retirement benefits, etc., and operating income excluding actuarial differences, etc. resulted in 393,694 million yen (+6.8% year on year).

7th Medium-Term Management Plan

The main theme of the 7th Medium‐Term Management Plan is to complete a sustainable growth model that will allow us to continue to grow in the future, even in the face of increasing uncertainty in the business environment.

Over the next five years, we will steadily promote reforms that will enable us to respond to various environmental changes in Japan and overseas. In particular, we recognize that the rising risk of climate change, soaring prices of materials and resources, and raw material supply risks are issues that must be addressed firmly by the Group as a whole. To complete a sustainable growth model, we have established three management policies: "Evolve revenue model," "Optimize management efficiency," and "Strengthen management base" and key themes for realizing them and we will steadily implement them.

By promoting these initiatives, we will evolve from a revenue model centered on contracting business to a more balanced revenue model that includes overseas and stock operations. In the final year, we aim to achieve net sales of 5,500 billion yen, operating income of 500 billion yen and net income attributable to owners of the parent of 340 billion yen.

With regard to shareholder return, our fundamental policy is to conduct investment in areas essential to growth – including real estate development, overseas projects, M&As, research and development, and production capacity – thereby raising earnings per share (EPS), so as to enhance the Group's shareholder value. We have set a target of dividend payout ratio at 35% or higher, and a minimum dividend amount per share of 145 yen. The Company will strive for stable shareholder returns and consider flexible treasury stock repurchasing.

The Daiwa House Group will continue to strive for sustainable enhancement of corporate value and creation of shareholder value with the aim of "Creating the fundamental societal infrastructure and lifestyle culture rooted in regeneration, ensuring a world where we live together in harmony embracing the Joys of Life".

We look forward to the continued support and encouragement of our shareholders, investors and all other stakeholders.