Medium-Term Management Plan

Daiwa House Group operates in a wide variety of business areas, in line with its motto “a group that co-creates value for individuals, communities, and people’s lifestyles”.

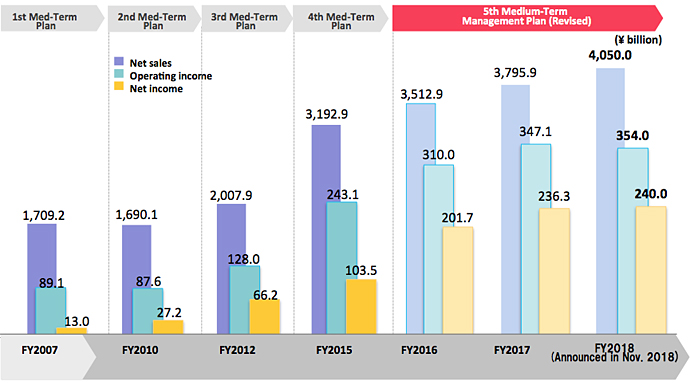

In our 5th Medium-Term Management Plan, started from April 2016, we aim to strengthen short- to medium-term growth potential and mark steps toward future growth

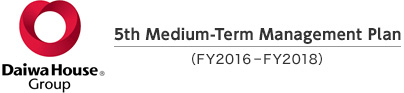

Also, we once again conduct an upward revision for our earnings forecast FY2018, last year of Fifth Medium-Term Management Plan, as we aim for further growth.

5th Medium-Term Management Plan

5th Medium-Term Management Plan (PDF 2.0MB)

- 1. Review of 4th Medium-Term Management Plan

- 2. Perception of Outside Environment

- 3. Basic Policies of 5th Medium-Term Management Plan

- 4. Performance Goals of 5th Medium-Term Management Plan

- 5. Earnings Goals by Business Segment

- 6. Strategies for Each Core Business

State of progress under 5th Medium-Term Management Plan, and policies going forward (May 2017) (PDF 1.1MB)

State of progress under 5th Medium-Term Management Plan, and policies going forward (May 2018) (PDF 1.6MB)

Performance goals of 5th Medium-Term Management Plan (revised upward in Nov. 2018)

Basic policies of 5th Medium-Term Management Plan

The theme of the 5th Medium-Term Management Plan is to capture domestic demand while preparing for future environment changes and building a platform for achieving 4 trillion yen in net sales.

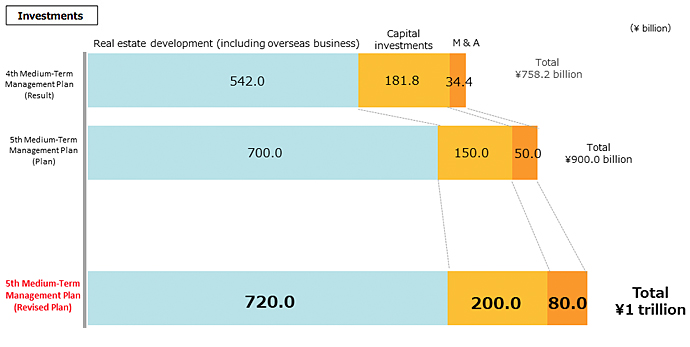

Planned investment(revised in May, 2018)

In light of past performance, we will expand our three-year investment plan goals from 900 billion yen to 1 trillion yen with a particular focus on expanding investments in Logistics, Business & Corporate Facilities Business and in overseas business.

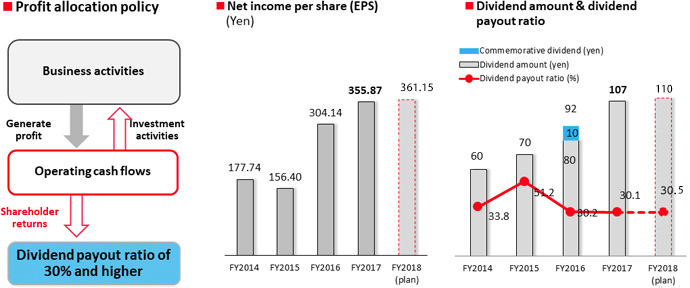

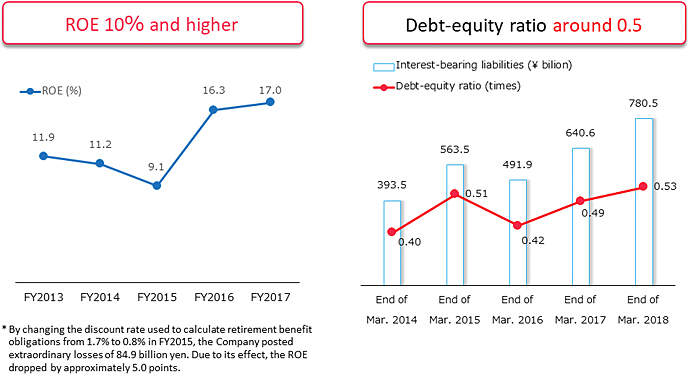

Maintain management efficiency and financial stability

Aim to sustain the growth of value for our shareholders by effectively using shareholder capital while maintaining financial health.

Shareholder return policy

By investing income created through business activities into growth areas, the Company enhances shareholder value by augmenting the net income per share.

The Company aims to maintain stable dividends and return profits to shareholders in line with business performance through a dividend payout ratio of 30% or higher of consolidated net income attributable to owners of the parent.