Medium-Term Management Plan

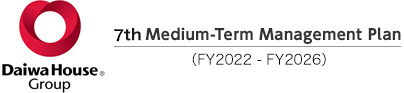

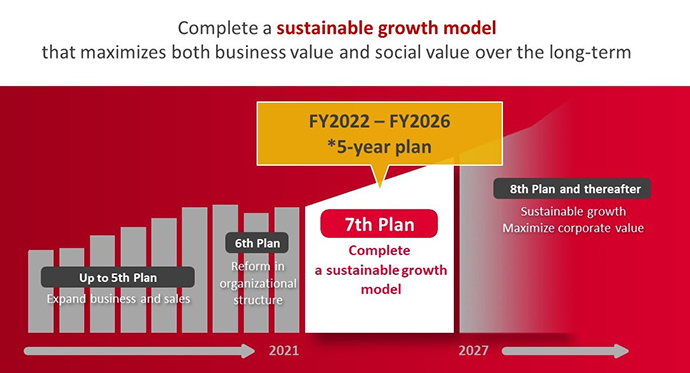

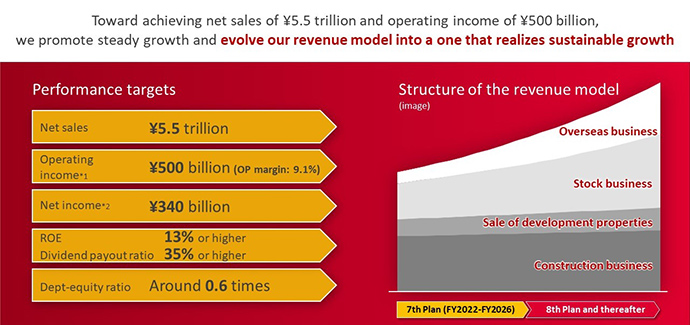

The Daiwa House Group has developed 7th Medium-Term Management Plan covering five years with 2022 as the first fiscal year. To complete a sustainable growth model, we have established three management policies: "Evolve revenue model," "Optimize management efficiency," and "Strengthen management base" and key themes for realizing them and we will steadily implement them.

November 13, 2024 Presentation on Management Policies

| Presenter | Keiichi Yoshii, President and CEO |

|---|---|

| Date | November 13, 2024 |

| Presentation materials | |

| Q&A |

Management policies and focal themes

Positioning of the 7th Medium-Term Management Plan

Performance targets

*1 Excluded amortization of actuarial differences *2 Net income attributable to owners of the parent

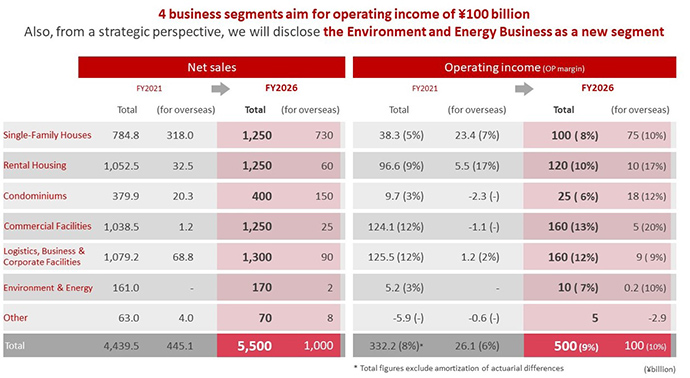

Performance targets by business segment

①Accelerate growth of overseas business

*1 As of the end of March 2022

*2 Supply plan is a combined total of single-family houses, rental housing and condominiums businesses in 5 years (on a consolidated basis)

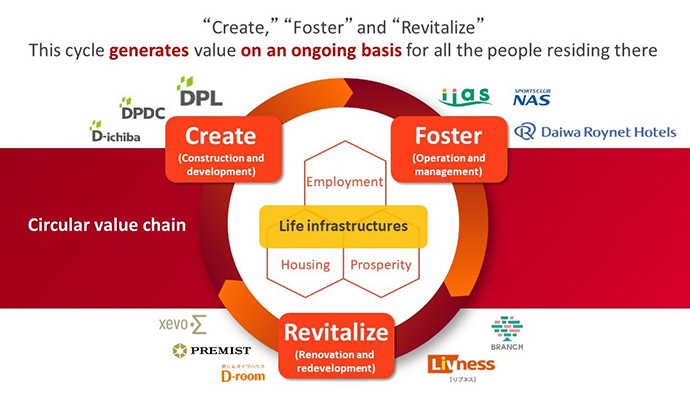

②Expand a circular value chain from the perspective of local communities/customers

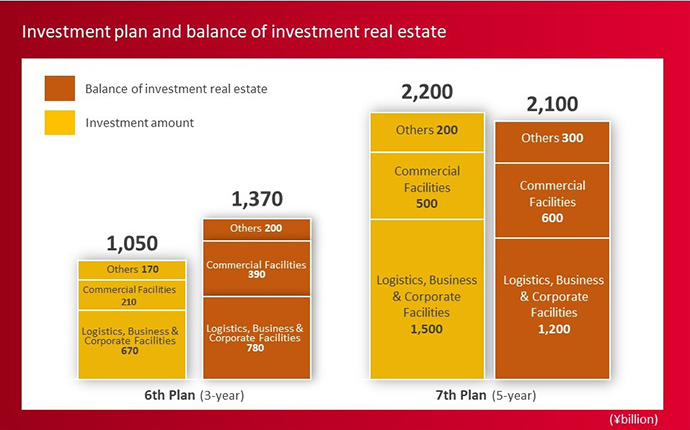

In order to contribute to the revitalization of local communities and develop businesses from a long-term perspective, we will develop advanced logistics facilities and data centers, including software proposals such as logistics DX for the development of next-generation infrastructure and job creation. We will revitalize and increase the value of aging facilities such as wholesale markets and retail facilities. To revitalize local communities, we will promote the redevelopment of complex facilities centered on regional mid‐tier cities. We will invest approximately 2.2 trillion yen in real estate development during the Seventh Medium-Term Management Plan.

* Total amount of investment in real estate development during the 7th Plan

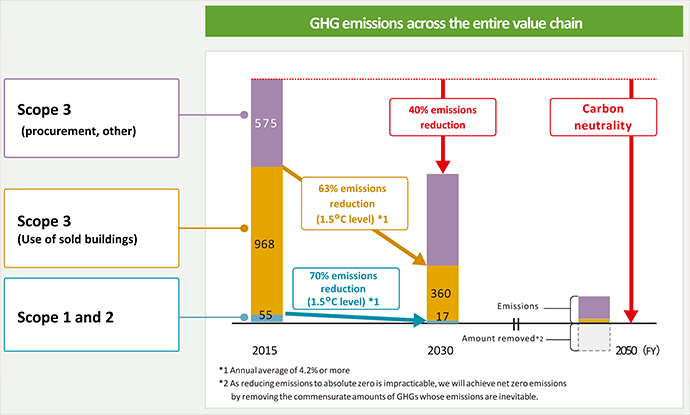

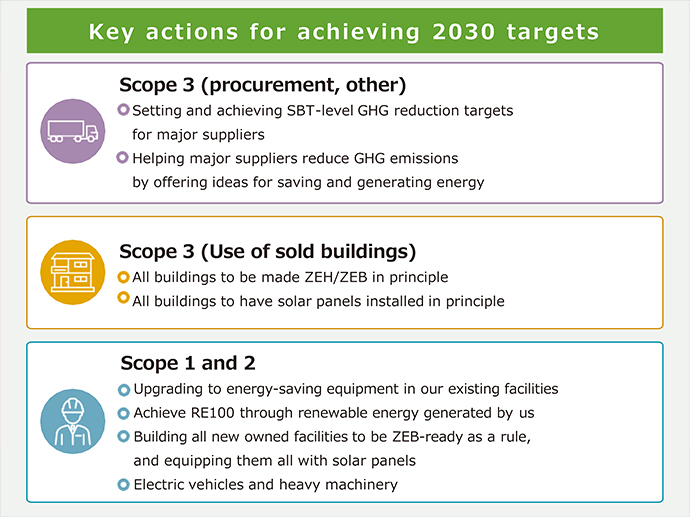

③Realize carbon neutrality by making all buildings carbon-free

Toward achieving carbon neutrality by 2050, we aim to reduce CO2 emissions by at least 40% across the entire value chain. We aim to achieve a ZEB/ZEH ratio of 100% and contribute to the spread of renewable energy by installing solar power generation systems on the roofs of all new buildings, as a rule.

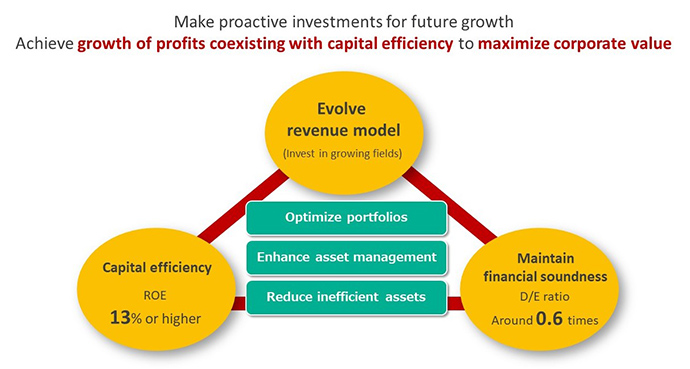

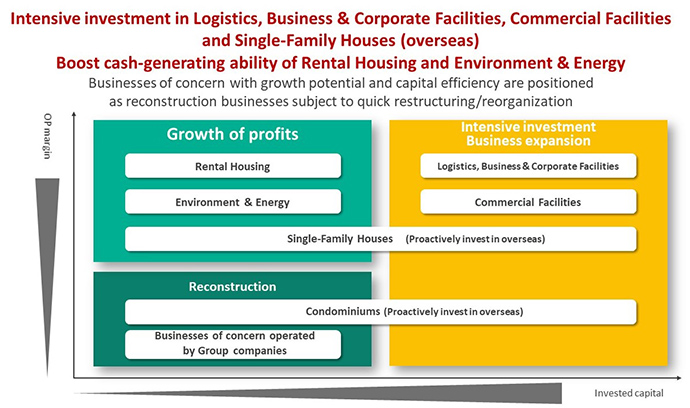

④Achieve growth of profits coexisting with capital efficiency through portfolio optimization

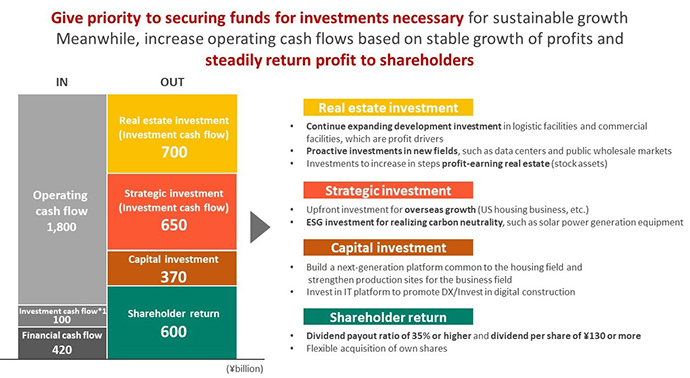

We aim to maximize corporate value by balancing these three goals: investing in growing fields, optimizing capital efficiency, and maintaining financial soundness.

We consider investments related to the establishment of a sustainable growth model to be our highest priority. We will accelerate the evolution of our profit model through overseas investments that drive growth, development investments to expand our recycling‐oriented value chain, and carbon neutral investments.

The dividend payout ratio will be 35% or higher, and the minimum dividend amount per share is set at JPY145.

⑤Strengthen cost competitiveness and build a system for stable supply

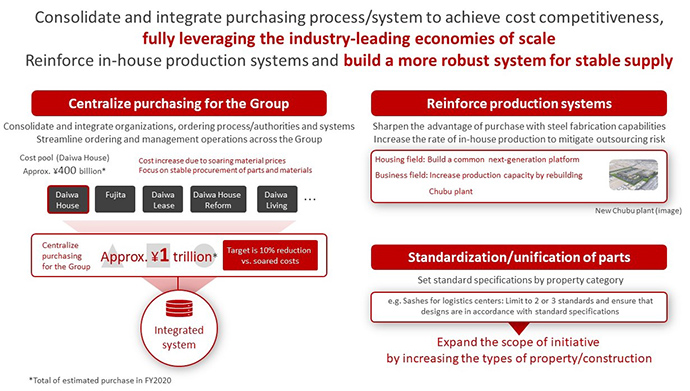

We will promote group centralized purchasing, which allows us to take full advantage of the economies of scale of being number one in the construction industry, and aim to curb costs by 10% after the cost increase. Furthermore, in order to ensure a stable supply of materials, the Company will reduce the risk of outsourcing by leveraging its strength in having its own steel frame fabrication capabilities and enhancing its production system.

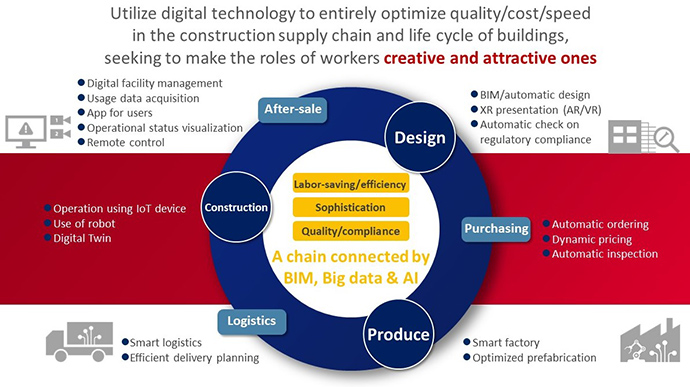

⑥Enhancing Customer Experience Value and Strengthening Technology Base through DX

In the area of DX, we will focus on increasing the value we provide to customers and strengthening our technology and manufacturing base. We utilize the vast amount of data from our industry‐leading business scale to make high‐quality, timely proposals at various points of contact with our customers.

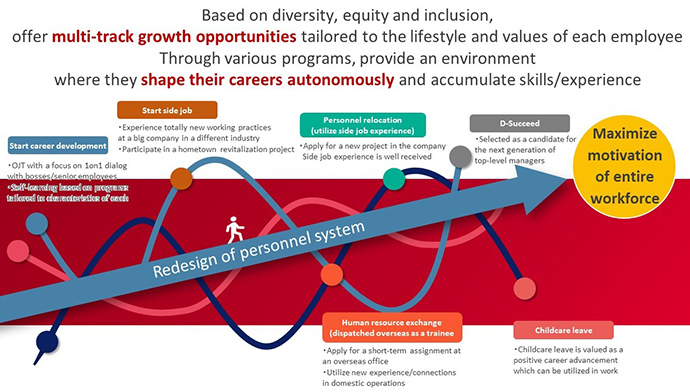

⑦Increase the value of our human capital

Since the Company’s founding, we have held up as our corporate motto the development of people through our business, and we believe that the tangible and intangible assets created by our business are maximized in value through human capital. We will enhance the growth and diversity of individuals, which will further lead to the knowledge and experience of the organization.

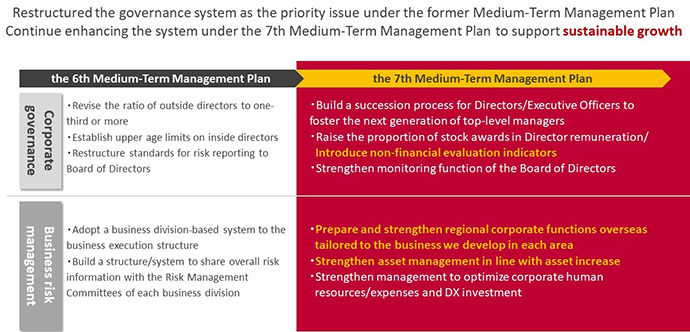

⑧Enhance governance

During the 7th Medium‐Term Management Plan period, we will continue to strengthen our governance structure in the 7th Medium-Term Management Plan. In particular, by strengthening the strategic governance structure that supports overseas growth and real estate development, we will achieve a balance between offensive and defensive management and support the Group's sustainable growth.