Business Segment*This page is updated semi-annually.

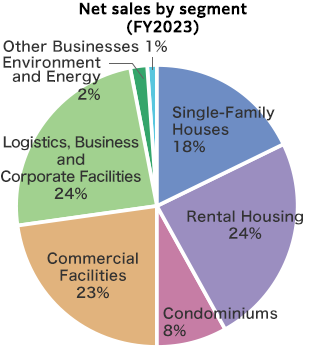

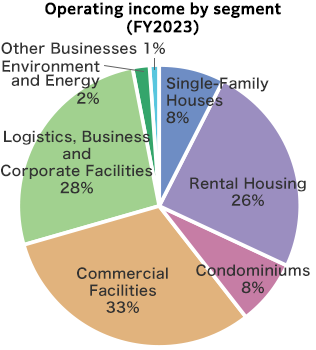

The percentage figures for breakdown of net sales and operating income by segment

- *Net sales represents sales to external customers.

- *Adjustments are included in the total but not shown on the graph. The percentage of each segment does not add up to 100%.

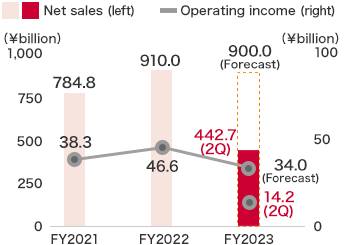

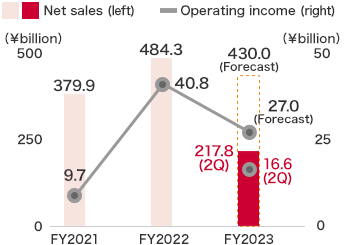

Single-Family Houses Business

In the Single-Family Houses Business segment, we provided energy-efficient, resilient and high-quality housing according to diverse requirements. We stayed close to residents’ lives and their changing values to propose lifestyles that will enhance their lives.

In the domestic housing business, the Company sought to strengthen initiatives for built-for-sale houses. The Company has been promoting the “Ready Made Housing.” concept for built-for-sale houses that inherit the quality of custom-built houses and providing high-quality houses in built-for-sale houses that aim to be worth more than their price, offering the same design excellence and quality as custom-built houses, a reassuring long-term home warranty, and after-sales support.

With regard to custom-built houses, in July 2024, the Company released products commemorating its 70th anniversary. These products include the xevoΣ PREMIUM SMILE Edition steel-framed housing product which has the highest specifications and the latest equipment, and the PREMIUM GranWood SMILE Edition wooden housing product. The Company also delivered the “Smart Made Housing.” concept for custom-built houses that provide the benefits of both custom designs and standardized houses, and it expanded its sales of its semi-custom-built houses (Smart Design) and standardized houses (Smart Selection).

Anticipating a society with a high demand for housing stock, the Company is focusing on the revitalization and regeneration of existing buildings. Especially in housing complexes developed by the Company, it works on the Livness Town Project, which aims to regenerate and redevelop communities by addressing social issues such as community revitalization and the problem of vacant houses. The Company tries to put itself in the shoes of those who live there and maintains a close relationship with the communities and the residents’ daily lives, so as to enhance the value of communities and ensure they remain attractive places to live for many years more.

Overseas, the Group has been expanding its operations in the eastern, southern and western regions of the United States, which it calls the smile zone. Three Group companies, Stanley Martin Holdings, CastleRock Communities and Trumark Companies play a key role in the east, south and west respectively. While the temporary trend in the market was a wait-and-see situation due to the expectations regarding lower housing loan interest rates, the existing home inventory was low. This led to firm demand for new homes, and the Company has continued to receive new orders.

As a result, net sales for this segment amounted to 501,750 million yen (+13.3% year on year), while operating income came to 22,042 million yen (+55.0% year on year).

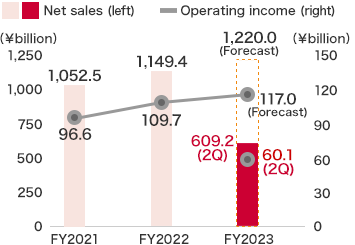

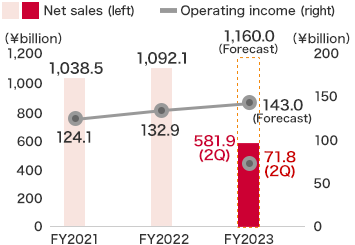

Rental Housing Business

In the Rental Housing Business segment, we have been proposing and supporting rental housing management that maximizes the asset value for owners by providing sustainable value while considering tenants, the global environment and the community. In addition, the Company sought to popularize ZEH-M (net Zero Energy House Mansion) properties that reduce environmental impact and support the saving and generation of energy. We also have expanded our order acquisition pipeline by focusing on built-for-sale business in which we sell to owners properties for which we have acquired land, planned development, designed and constructed, and conducted leasing-out to tenants.

Daiwa Living Co., Ltd. provides D-room rental housing properties that offer high-quality and comfortable living and are chosen by a wide range of tenants. The company also expanded its renovation business. As a result, the number of units under management increased and the occupancy rates remained high.

Daiwa House Chintai Reform Co., Ltd. worked to strengthen relationships through periodic inspections and diagnosis in rental housings constructed by the Company and promoting warranty extension work and renovation proposals.

Meanwhile, overseas in the United States, where the Company is developing rental housings, interest rates remained high. However, the Group aims to maximize rental revenues while closely monitoring the real estate market trends, including interest rates. The Group will strive to increase occupancy rates and profitability with the goal of promptly selling properties when the market improves.

As a result, net sales for this segment amounted to 661,177 million yen (+8.5% year on year), while operating income came to 65,807 million yen (+9.4% year on year).

Condominiums Business

In the Condominiums Business segment, we sought to provide basic housing performance essential for a long housing life, comfort, safety and a management structure, drawing on our knowhow as a home builder to meet the diverse lifestyle needs of potential residents. We are also striving to create high added-value condominiums which, in addition to asset value for the customer, also consider the environment and society and aim to contribute to local communities.

PREMIST Miyazakidai RISETERRACE (Kanagawa Prefecture), which began to be sold in July 2024, simultaneously obtained ZEH-M Ready and Nintei Tei-tanso Jutaku (certified low-carbon house) certifications, a first for one of the Company's condominiums. Their sales have been steady, with the location being evaluated highly as it features both a natural environment and convenience.

In addition, in July 2024, the Company signed a naming rights agreement for Sapporo Dome. In August of the same year, Sapporo Dome was nicknamed Daiwa House PREMIST DOME after the Company's brand of condominiums. By increasing the awareness of the brand of the residents of the surrounding area and the users of the facility, the Company will increase the visibility of its name, businesses, and others and its brand power and enable Daiwa House PREMIST DOME to contribute to the local community as a facility that is familiar to them.

Daiwa LifeNext Co., Ltd. was ranked first for five consecutive years since 2020 in the Replace category of the condominium management company in the Tokyo Metropolitan Area division of the 2024 ORICON Customer Satisfaction Survey. The Company will expand its menu of services to continue to provide optimal proposals based on a correct understanding of the issues faced regarding each condominium, in its efforts to provide a comfortable condominium life to each customer.

However, mainly due to the change of Cosmos Initia Co., Ltd. from a consolidated subsidiary of the Company into an affiliate accounted for by the equity method in the previous consolidated fiscal year, net sales for this segment amounted to 132,873 million yen (-39.0% year on year), while operating income came to 13,585 million yen (-18.6% year on year).

Commercial Facilities Business

In the Commercial Facilities Business segment, we offered various plans that meet the needs of tenant corporations, taking advantage of their business strategies and the characteristics of each region. In particular, we strengthened our efforts in the field of large-scale properties and in built-for-sale business in which we sell to investors properties for which we have acquired land, planned development, designed and constructed, and conducted leasing-out to tenants. At the same time, we also worked to improve the profitability of the construction business at the time of order receipt.

In the home center business, Royal Home Center Co., Ltd. opened Royal Pro Owariasahi (Aichi Prefecture) in July 2024. As of September 30, 2024, the total number of stores was 65.

In the urban hotels business, the occupancy rate of Daiwa Roynet Hotels, which is operated by Daiwa House Realty Mgt. Co., Ltd., remained strong due to demand from inbound tourists, and the average occupancy rate for April to the end of September 2024 was 87.8%.

Daiwa Lease Co., Ltd. held the groundbreaking ceremony for Frespo Asahikawa Ryukoku (tentative name) in Asahikawa City, Hokkaido Prefecture in July 2024. A total of 11 stores, including one consumer electronics mass retailer store, are planned to open on the approx. 20,000 square meters site of Asahikawa Ryukoku High School, which has been relocated. Toward its grand opening in October 2025, we will strive to build a facility which will improve convenience for local residents.

Overseas, the Group operated TRADE and Village Center commercial facilities in California, USA. The Group consistently maintained high occupancy by soliciting Japanese tenants. In addition, in the hotel development business, the Group has started work on IHG Orlando Hotel in Florida, Hotel Nikko Kaohsiung in Taiwan, and KROMO, Curio Collection by Hilton in Bangkok, the capital of the Kingdom of Thailand, aiming for continued expansion in the future.

Further, the Company and Daiwa Lease Co., Ltd. participate in the Kapalua Village Project, a project implemented by TY Management Corporation to construct emergency temporary housing in the Kapalua area of Maui, Hawaii in the United States. The housing project was completed* on August 7, 2024. The Group will continue to work with its stakeholders, aiming to help solve global social issues.

As a result, net sales for this segment amounted to 613,630 million yen (+5.4% year on year), while operating income came to 78,600 million yen (+9.4% year on year).

* Overall completion occurred in September 2024.

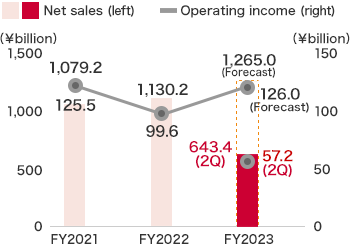

Logistics, Business and Corporate Facilities Business

In the Logistics, Business & Corporate Facilities Business segment, we worked to enhance the Group’s business scope by constructing a variety of facilities to suit the differing business needs of our corporate customers, and by providing total support services that enable customers to utilize their assets most effectively. At the same time, we also worked to improve the profitability of the construction business at the time of order receipt.

Regarding logistics facilities, two facilities were completed in the three months from July 2024. They are DPL Osaka Maishima and DPL Takasaki (Gunma Prefecture), which are large hybrid warehouses with freezing and refrigeration capabilities. Leasing progressed steadily. Lease agreements were signed for DPL Sapporo Rail Gate (Hokkaido Prefecture), DPL Hiratsuka (Kanagawa Prefecture), DPL Osaka Maishima, and others. Further, construction of two facilities was commenced in the above period. They are DPL Osaka Nanko I, a large freezing and refrigeration facility, and DPL Kuki Miyashiro II (Saitama Prefecture), a large freezing and refrigeration facility for one-building rental.

Regarding medical and nursing care facilities and urban development facilities, D-Tower Toyama, a multi-tenant building with commercial facilities and offices that had been under construction in the D-Tower development project, opened in July 2024. This facility received an A rating in the CASBEE-Wellness Office evaluation and certification program. It is managed by Daiwa House Property Management Co., Ltd., a Group company. We will continue to propose urban development projects including building complexes and CCRC*.

Regarding support for offices, plants, and other business sites, development of industrial parks remained strong. As of September 2024, the Group had 134 subdivisions for sale in 42 industrial parks with an area of approximately 3.2 million square meters.

In the Livness business, the Group sold D Project Sukagawa II (Fukushima Prefecture) in buying and reselling.

Daiwa House Property Management Co., Ltd., a company that mainly manages and operates logistics facilities developed by the Company, concluded new property management agreements for four logistics facilities and others including DPL Osaka Maishima, increasing the number of facilities and the area under management to 251 facilities and approximately 10.41 million square meters.

Regarding overseas businesses, in August 2024 the Company began the construction of Blue Ridge Commerce Center, the Company's first logistics facility development project in the United States, with Trammell Crow Company, a major real estate developer, in Southwest Houston, Texas in the United States. Going forward, the Company will continue accelerating the development of logistics, business & corporate facilities in the United States and ASEAN.

As a result, net sales for this segment amounted to 717,767 million yen (+11.6% year on year), while operating income came to 83,690 million yen (+46.1% year on year).

* The Continuing Care Retirement Community is an initiative for the development of communities whose members can lead healthy, active lives, interacting with local residents and many different generations, and can access medical and nursing care where necessary.

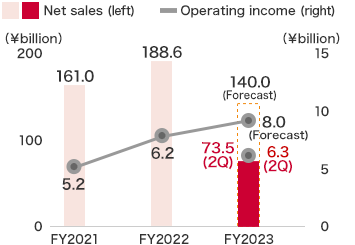

Environment and Energy Business

In the Environment and Energy Business, amid the current acceleration of transition toward decarbonization and the growing demand for renewable energy, the Group promoted three businesses, the EPC business (design and construction of power plants for renewable energy), the PPS business (electric power retail business) and the IPP business (electric power generation business).

In the EPC business, the Group is working to expand two PPA-related businesses, off-site PPA (Power Purchase Agreement) with the goal of supplying renewable energy to a purchaser far from a solar power generation facility and on-site PPA with the goal of supplying renewable energy directly from a solar power generation facility installed on a roof or in an adjacent area. Demand for renewable energy is increasing steadily. The Company will leverage the land development knowhow it has built up since its foundation to secure sites for solar power generation facilities in suitable locations and will collaborate with major energy companies to develop users, and will continue focusing efforts on the EPC business as a mainstay business for the future.

In the PPS business, profitability improved as a result of the stabilization of spot prices in the electricity wholesale market alongside initiatives such as introduction of power procurement adjustment costs (fuel cost adjustments set independently). It is difficult to predict trends in the business environment in the electric power industry, so we will work to stabilize the PPS business while taking measures to address the risks of the business.

In the IPP business, the Company engages in the operation of wind power generation and hydroelectric power generation, as well as solar power generation, which is its main business, at 600 locations nationwide.

This business segment will continue to play a key role in initiatives to “realize carbon neutrality by making all our buildings carbon-free,” one of the focal themes in the 7th Medium-Term Management Plan. We will promote these efforts throughout the Group and contribute to the further expansion of renewable energy.

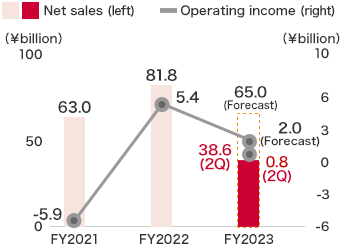

As a result, net sales for this segment amounted to 62,962 million yen (-14.4% year on year), while operating income came to 7,165 million yen (+12.9% year on year).

Other Businesses

Net sales for this segment amounted to 25,447 million yen (-34.2% year on year), while operating income came to 2,032 million yen (+139.1% year on year).

Notes:

1. Net sales for each segment include internal (inter-segment) sales and transfers in addition to sales to external customers.

2. The above monetary amounts are exclusive of consumption tax, etc.