Shareholder Return Policy and Dividends

Basic policy on shareholder returns

To return to shareholders the value it has created through its business activities, the Company’s basic policy on shareholder returns is to enhance shareholder value by maximizing corporate value over the medium to long term. To achieve this, the Company invests in growth areas such as real estate development, the expansion of overseas business, M&A, research and development and production facilities in a bid to augment earnings per share (EPS).

The Company aims to maintain stable dividends and return profits to shareholders in line with business performance through a dividend payout ratio of 35% or more of consolidated net income and devidend per share of ¥145 or more.

The Company also purchases its own shares when the timing is appropriate, taking such factors as the market environment and capital efficiency into consideration.

Basic Policy on Shareholder Returns(PDF 33KB)

(Corporate Governance Guidelines)

Profit allocation policy

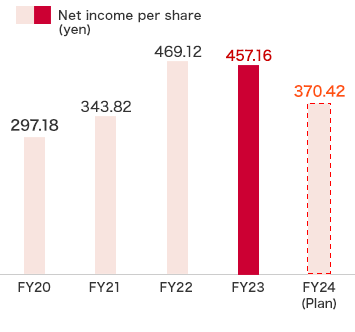

Net income per share

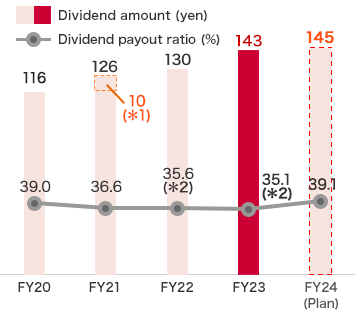

Dividends and dividend payout ratio

*1:Commemorative dividend

*2:calculated excluding the effect of actuarial differences