Business Segment*This page is updated semi-annually.

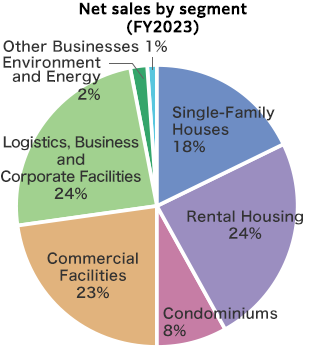

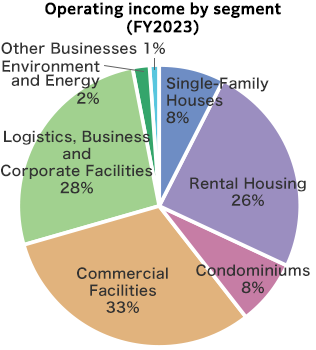

The percentage figures for breakdown of net sales and operating income by segment

- *Net sales represents sales to external customers.

- *Adjustments are included in the total but not shown on the graph. The percentage of each segment does not add up to 100%.

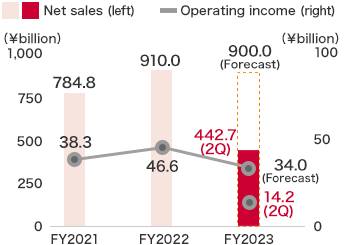

Single-Family Houses Business

In the Single-Family Houses Business segment, we provided energy-efficient, resilient and high-quality housing according to diverse requirements. We stayed close to residents' lives and their changing values to propose lifestyles that will enhance their lives.

In the domestic housing business, the Company primarily promoted sales of “xevoΣ,” their mainstay steel-framed housing product, and “skye,” a three- to five-story steel-framed house, to increase the ZEH (net zero energy house) sales ratio. Additionally, the Company sold the “xevo GranWood” wooden housing product and its most luxurious “Wood Residence MARE” housing product, which caters to the wealthy, to contribute towards the achievement of carbon neutrality and meet diverse needs of customers. The “Yasuragu Ie” relaxing home in the “Oto no Jiyu-ku” free sound zone series of houses, which the Company has been offering since April 2023, proposing comfortable soundproof rooms and comfortable quiet rooms, won the Minister in Charge of Policies for Children Award in the designs to support comfortable raising of children category at the 17th Kids Design Award in September 2023. In built-for-sale houses, we focused our efforts on solving customer issues and identifying changes in society so that many customers can choose valuable products.

Anticipating a society with a high demand for housing stock, the Company is focusing on the revitalization and regeneration of existing buildings. Especially in housing complexes developed by the Company, it works to revitalize local communities and addresses social issues such as the problem of vacant houses. The Company collaborates with residents in the revitalization and redevelopment of areas, aiming to achieve sustainable development.

Overseas, the Group has been expanding its operations in the eastern, southern and western regions of the United States, which it calls the smile zone. Three Group companies, Stanley Martin Holdings, CastleRock Communities and Trumark Companies play a key role in the east, south and west respectively. While housing loan interest rates and housing prices remained high, the existing home inventory was low. This led to firm demand for new homes, and there were signs of a recovery. The Company will continue to increase its off-site construction to expand its market share in its operating areas.

As a result, net sales for this segment amounted to 442,768 million yen (+5.9% year on year), while operating income came to 14,222 million yen (-29.8% year on year).

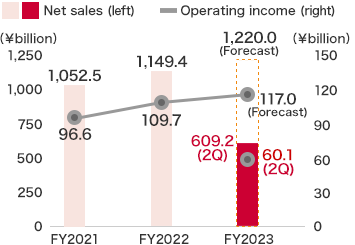

Rental Housing Business

In the Rental Housing Business segment, we have been proposing and supporting rental housing management that maximizes the asset value for owners by providing sustainable value while considering tenants, the global environment and the community. In addition, the Company sought to popularize ZEH-M (net Zero Energy House Mansion) properties that reduce environmental impact and support the saving and generation of energy.

Daiwa Living Co., Ltd. provides D-room rental housing properties that offer high-quality and comfortable living and are chosen by a wide range of tenants. The company also expanded its renovation business. As a result, the number of units under management increased and the occupancy rates remained high. To improve efficiency in the real estate industry, Daiwa Living Co., Ltd. and Daitokentaku Partners Co., Ltd. established Real Estate Information Management Organization., Ltd. in July 2023*. The new company aims to increase the accuracy of information and convenience in the real estate industry by linking the Rental Housing ID assigned to each rental property with the real estate ID. Its objective is to promote digital transformation in the real estate industry.

Overseas, in Australia, where, as in the United States, the population is expected to steadily grow, the Group launched the Melbourne Quarter West Project to develop rental housing and solve the housing shortage issue. In the United States, the Group aims to maximize rental revenues while closely monitoring the real estate market trends, including interest rates. Meanwhile, the Group will strive to increase occupancy rates and profitability with the goal of promptly selling properties when the market improves.

As a result, net sales for this segment amounted to 609,277 million yen (+5.1% year on year), while operating income came to 60,172 million yen (+13.1% year on year).

*After the company is established, Zenrin Co., Ltd. will invest in it.

Condominiums Business

In the Condominiums Business segment, we sought to provide basic housing performance essential for a long housing life, comfort, safety and a management structure, drawing on our knowhow as a home builder to meet the diverse lifestyle needs of potential residents. We are also striving to create high added-value condominiums which, in addition to asset value for the customer, also consider the environment and society and aim to contribute to local communities.

PREMIST Akishima MoriPark Residence (Tokyo) started selling in September 2023. It is the first residential property in the Tokyo Akishima MoriPark area, which has a variety of attractive facilities such as commercial facilities, sports facilities and hotels. The large property has well-received shared facilities and sales are progressing steadily. PREMIST Chiba Park commenced sales in September 2023. It is located adjacent to Chiba Park, which is easily accessible from JR Chiba station by foot and covers a massive area of approximately 16 hectares. It is highly appreciated because of its convenience for daily living and its greenery-filled surroundings. Sales are progressing steadily.

Daiwa LifeNext Co., Ltd. launched Flat Car Sharing, a monthly flat-rate car-sharing service exclusively for residents of condominiums managed by the company. The company plans to launch Flat Car Sharing and parking facility sub-leasing package. This will lease vacant parking lots to non-residents, helping to improve the management association’s earnings and make residents’ lives more convenient and comfortable.

Overseas, the Group participated in a condominium development project in London, UK for the first time in addition to projects in China, their primary operating area. The Group will use their expertise developed in Japan and China to help solve the social problem of the chronic housing shortage in the UK.

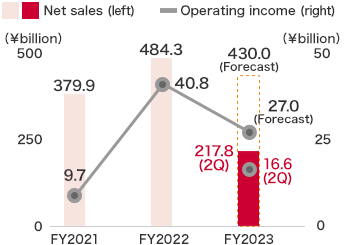

As a result, net sales for this segment amounted to 217,820 million yen (+25.1% year on year), while operating income came to 16,697 million yen (+84.1% year on year).

Commercial Facilities Business

In the Commercial Facilities Business segment, we offered various plans that meet the needs of tenant corporations, taking advantage of their business strategies and the characteristics of each region. In particular, we strengthened our efforts in the field of large-scale properties and in built-for-sale business in which we sell to investors properties for which we have acquired land, planned development, designed and constructed, and conducted leasing-out to tenants.

In the urban hotels business, as of September 30, 2023, Daiwa House Realty Mgt. Co., Ltd. managed a total of 75 hotels with 16,176 rooms in Japan. In the three months from July 2023, the average occupancy rate improved to approximately 88%, and business performance remained steady.

In the fitness club business, Sports Club NAS Co., Ltd. aimed to improve profitability by intensifying promotions and reducing costs through a revision of membership fees and a review of club operations to enhance efficiency.

Overseas, the Group operated TRADE, a commercial facility, and acquired Village Center in California, USA. The Group consistently maintained high occupancy by soliciting Japanese tenants.

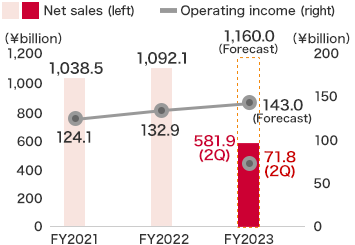

As a result, net sales for this segment amounted to 581,916 million yen (+10.6% year on year), while operating income came to 71,822 million yen (+14.8% year on year).

Logistics, Business and Corporate Facilities Business

In the Logistics, Business & Corporate Facilities Business segment, we worked to enhance the Group’s business scope by constructing a variety of facilities to suit the differing business needs of our corporate customers, and by providing total support services that enable customers to utilize their assets most effectively.

Regarding logistics facilities, DPL Sapporo Minami III (Hokkaido Prefecture) was completed in August 2023, and DPL Shin-Yokohama III (Kanagawa Prefecture) and DPL Takatsuki (Osaka Prefecture) were completed in September 2023. The completion of these facilities symbolizes the Company's nationwide development of logistics facilities. The Company started constructing a very large facility, DPL Chiba Yotsukaido II with a total floor area of over 300,000 square meters. Additionally, the Company is developing a new urban facility, DPL Shinonome, in Tokyo. It is located in a prime location in the center of the city. Irrespective of the changes in the market environment, the Company aims to meet the solid demand for facilities by leveraging its strong leasing capabilities and continuing to develop new facilities.

The Group steadily received orders for support related to offices and plants from industrial parks it developed by the Company. As of September 30, 2023, the Group had 106 subdivisions for sale in 50 industrial parks with an area of approximately 2.6 million square meters.

Daiwa House Property Management Co., Ltd., a company that mainly manages and operates logistics facilities developed by the Company, concluded new property management agreements for 3 logistics facilities including “DPL Shin-Yokohama III (Kanagawa Prefecture) that was completed in September 2023, increasing the number of facilities and the area under management to 244 facilities and approximately 9.8 million square meters.

The Daiwa LogiTech Group is a logistics service provider that caters to the IT businesses of corporate customers. These customers have been increasing their investments in IT since the beginning of the digital transformation. As a result, the Daiwa LogiTech Group is receiving more inquiries about the digital transformation of logistics, including consultations on the implementation of automated logistics systems and logistics base networks. In the logistics business, the growth of e-commerce for merchandise has slowed slightly, however, major clients’ shipments remained steady. The company will continue to conduct sales efforts aimed at drawing in new customers.

Overseas, the Group is striving to improve the occupancy rate and profitability to maximize earnings, aiming to sell properties and shares in the logistics warehouse business in the ASEAN region, its main operating area.

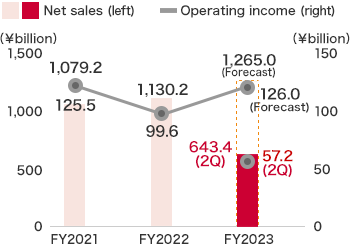

As a result, net sales for this segment amounted to 643,445 million yen (+29.6% year on year), while operating income came to 57,299 million yen (+48.7% year on year).

Environment and Energy Business

In the Environment and Energy Business, amid the current acceleration of transition toward decarbonization and the growing demand for renewable energy, the Group promoted three businesses, the EPC business (design and construction of power plants for renewable energy), the PPS business (electric power retail business) and the IPP business (electric power generation business).

To facilitate initiatives in the EPC business with the termination of Japan’s FIT program (the feed-in tariff scheme for renewable energy), the Group is working to expand two PPA-related businesses, off-site PPA with the goal of supplying renewable energy to a purchaser far from a solar power generation facility and on-site PPA (Power Purchase Agreement) with the goal of supplying renewable energy directly from a solar power generation facility installed on a roof or in an adjacent area. In September 2023, DREAM Solar Ishikawa Hakui Horikaeshinmachi, the Company’s first ground-mounted solar power generation facility for off-site PPA, began operating. Demand for renewable energy is increasing steadily. The Company plans to develop large solar power facilities using nationwide land information that it has accumulated since its foundation. The Company will make them a core business.

In the PPS business, the business environment continues to be difficult, reflecting surging power purchase prices due to the prolonged situation in Russia and Ukraine and rising resource prices attributable to the depreciation of the yen. However, profitability improved following the proposal of a new rate structure, the control of the supply of power according to the amount of power procured, and other initiatives, in addition to the stabilization of wholesale power market spot prices. Although it is difficult to predict trends in the business environment in the electric power industry, we will work to stabilize the PPS business while taking measures to address the risks of the business.

In the IPP business, the Company engages in the operation of wind power generation and hydroelectric power generation, as well as solar power generation, which is its main business, at 498 locations nationwide.

This business segment will continue to play a key role in initiatives to “realize carbon neutrality by making all our buildings carbon-free,” one of the focal themes in the 7th Medium-Term Management Plan. We will promote these efforts throughout the Group and contribute to the further expansion of renewable energy.

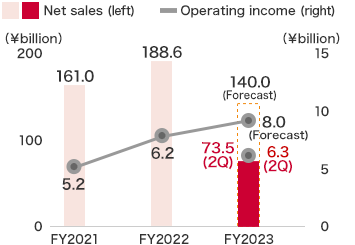

As a result, net sales for this segment amounted to 73,587 million yen (-15.8% year on year), while operating income came to 6,344 million yen (+169.3% year on year).

Other Businesses

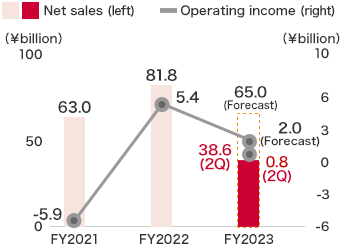

Net sales for this segment amounted to 38,660 million yen (-3.8% year on year), while operating income came to 850 million yen (-68.1% year on year).

Notes:

1. Net sales for each segment include internal (inter-segment) sales and transfers in addition to sales to external customers.

2. The above monetary amounts are exclusive of consumption tax, etc.